By paying out a reduced fascination rate in the primary several years, it is possible to enjoy lowered regular mortgage payments, giving you a lot more economical versatility throughout the early levels of homeownership.

We're devoted to reinventing the mortgage loan lending product as a way to give exceptional services, small rates, and several of the fastest closing moments during the marketplace.

To supply you with the best on the web knowledge, Ramsey Alternatives takes advantage of cookies and other monitoring systems to collect details about you and your Web-site knowledge, and shares it with our analytics and advertising and marketing partners as explained in our Privateness Plan. By continuing to browse or by closing out of the information, you point out your settlement.

That way, you’ll have the ability to make the most beneficial selection for both you and your relatives once you purchase a house. Exactly what is a Mortgage loan Buydown?

Join our e-newsletter! It’s packed with useful suggestions to assist you deal with the housing current market and purchase or sell your property with assurance—shipped straight to your inbox twice per month!

Never drop into your trap of purchasing a house loan buydown or almost every other difficult financial solution that claims for making homeownership much easier. Buying a house The great ol’ fashioned way by saving up a deposit, finding a traditional home loan that you can afford to pay for, and building the payments (or, even better, shelling out your home finance loan off early) remains The simplest way to go. Bear in mind: Only buy a property if you can manage the

” Here is the issue at which the money you’ve saved about the permanent curiosity amount price cut outweighs the upfront costs you (or the seller) paid for that lower price. This breakeven is normally reached close to 12 months five of your home financial loan.

Additionally, the enhanced affordability of your home over the buydown time period will make it more captivating to probable prospective buyers if you decide to promote. General, a three-2-one buydown home finance loan is usually a worthwhile tool in obtaining your homeownership and economic ambitions.

You’ll also want to ensure that the house is rather priced to start with and that the vendor isn’t padding the value to cover the buydown costs.

It usually enables them to attain the entire inquiring value on their own household, when also incentivizing buyers to speculate in property.

Do you think you're during the real estate property market to buy a home and in search of strategies to avoid wasting on your home loan payments? If so, you’ve arrive at the ideal area! In this particular blog site publish, we’ll be speaking about 3-two-1 buydowns, an intriguing option for property consumers.

While you’re under-going the whole process of purchasing a dwelling and acquiring a home loan, chances are you'll run into a get more info number of myths about buydowns that can guide you to produce a extremely terrible decision. Myth: “A buydown is a great way to get about substantial curiosity charges. Just purchase the buydown now, then refinance following 3 decades when charges have absent back down.

It is comparable for the observe of buying discount factors on a home finance loan in return for any lower fascination rate, other than that it's short term.

Assisting prospects like you reach their economic goals is all we do, And that's why we’re arming you with our professional Perception, tips, and assistance that can assist you get there.

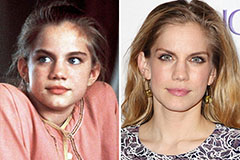

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!